Highlights

- Web Payments get smarter with Chrome Autofill now showing rewards for 100+ U.S. credit cards.

- More flexibility in Web Payments with BNPL options like Affirm, Zip, Klarna, and Afterpay.

- Clearer Web Payments experience with upfront fees and exchange rates in Google Wallet and Search.

- Faster, more transparent Web Payments for international transfers through Ria, Xe, and Wise partnerships.

Google has improved web payments through more options, ease, and openness. Google has introduced three new tools to improve and streamline customers’ online payment experiences. The efforts seek to make online payments easier than ever before by providing more options for large-ticket items, daily purchases, and international money transfers.

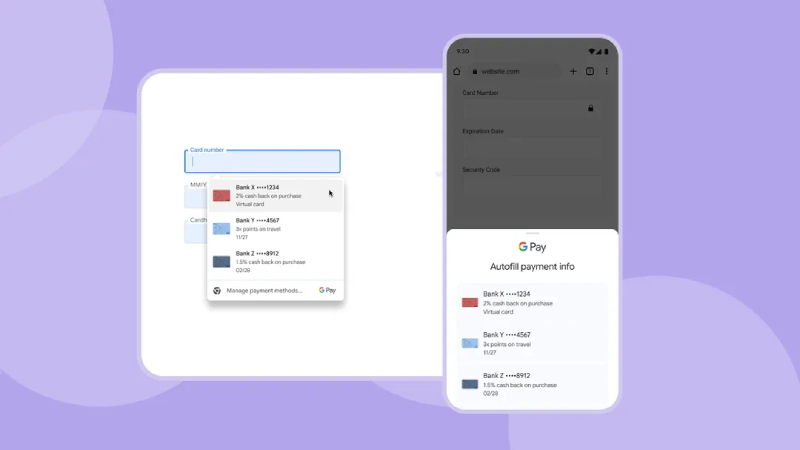

Broader Visibility of Credit Card Rewards in Chrome Autofill

Chrome’s autofill feature now shows reward details for more than 100 U.S. credit cards, rather than just the previously small number like American Express and Capital One, to assist users in making more informed payment decisions. Customers can easily compare features like “1.5% cash back” or “3× points on travel,” as autofill rewards, which are prominently displayed beside the card name and logo, once they arrive at the checkout page. Users may now easily select the most lucrative card for every purchase thanks to this improvement.

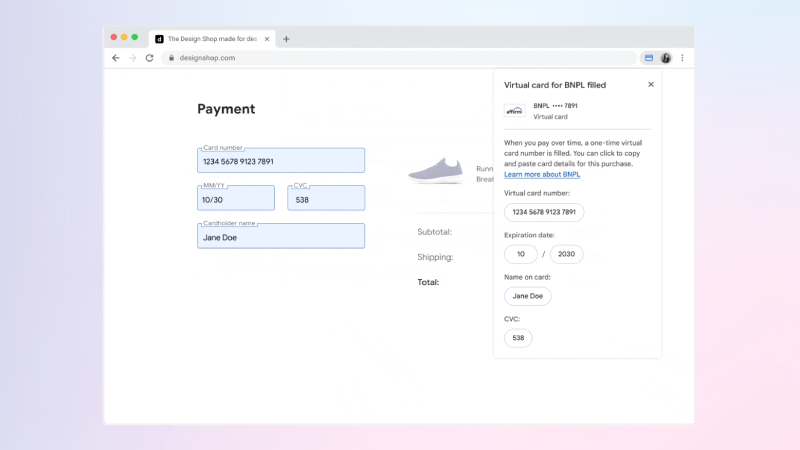

Expanded “Buy Now, Pay Later” Options Directly in Chrome

By adding more pay-over-time financing alternatives to Chrome’s autofill dropdown menu, Google has significantly expanded its previous test program, which was previously restricted to Affirm and Zip. A wider range of BNPL providers, including Klarna, Afterpay, and others on the horizon, are now visible to and available to American consumers. Chrome creates a virtual card tailored to that purchase when customers choose a BNPL option, providing a smooth financing process without requiring them to exit the browser.

Simplified Global Money Transfers via Wallet and Google Search

Additionally, Google is improving the transparency and usability of international money transactions. Google will now clearly display fee and rate information alongside remittance providers like Ria Money Transfer, Xe and Wise on wallet.google.com, and even immediately through Google Search when users check exchange rates.

Below the currency chart, users will find a “Compare quotes & send money” option that allows them to compare prices and start transfers with a few clicks. To facilitate this feature, a special “International transfers” page will be added to the Wallet website.

Consumer Benefits and Market Context

When combined, these improvements provide a more efficient and knowledgeable buying experience. Google gives users the ability to maximize value and manage spending more flexibly by presenting card rewards and flexible payment choices like BNPL. Global remittances, a sector that is becoming increasingly dynamic due to embedded financial trends, experience reduced friction as a result of the increased transparency and simplicity of cross-border payments.

Google’s enhanced autofill, payment options, and remittance visibility position its platforms as key centers for both local and international money movement, all within a few clicks. E-commerce and digital payments continue to develop.

Strengthening Trust Through Transparency

The emphasis on transparency in these revisions is among its most noteworthy features. Google provides important information at the precise moment that customers need it, whether they are comparing card rewards, comprehending BNPL agreements, or verifying actual currency rates. In a time when online fraud and hidden costs can erode trust in digital payments, this fosters trust, which is vital.

Positioning for the Future of Digital Commerce

Additionally, Google’s action suggests a larger plan to further include payments into its ecosystem. The business is establishing itself as more than just a search engine by fusing financial data with autofill features, turning it into a major hub for online transactions. These capabilities have the potential to make Google an essential component of daily business as more retailers use BNPL and international remittances continue to increase.

By making these changes, Google is not only meeting the demands of its users today but also getting ready for a time when instantaneous, educational, and international online payments will be the norm. Online payments have simply gotten smarter, quicker, and more transparent for both senders and buyers.